Managing money, paying bills on time, and tracking transactions can be overwhelming tasks. For a business, keeping all the customers happy is also a task that’s not humanly possible.

But to save us from all the hustle, finance chatbots are in business. The best finance chatbots help you with all these tasks, leaving you to spend your time on more pressing matters or enjoy it with your family.

With the advancement in AI technology, so many finance chatbots are available. The real task is determining which chatbot is most efficient for your business, which is not easy. We solved that problem and listed and reviewed the best ones available in this post.

7 Best Finance Chatbot Reviews

Time is money, and you might waste hours and hours finding the best finance chatbots. So, we took the matter to ourselves and found the top 7 chatbots available to help you with your financing.

Clepher

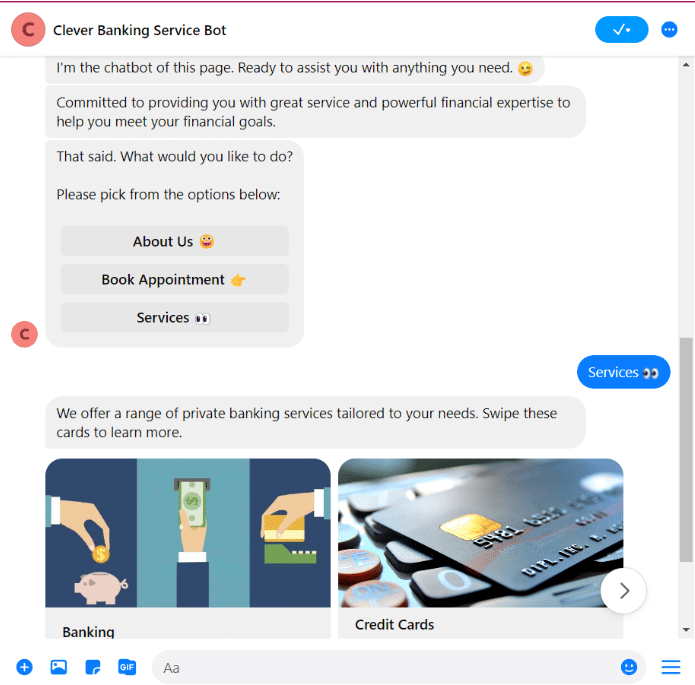

Clepher has turned the waves with its most simple and conversational finance chatbots. It has 220+ templates, four of which are the finance chatbots, i.e., accounting firm chatbot, banking service chatbot, insurance assistance chatbot, and loans agency chatbot. These four templates cover pretty much everything regarding finance in real life.

Clepher Banking Service Bot

Clepher promises the most efficient customer service with its brilliant chatbots and minimizes the need for a human agent to deal with a client.

It has many satisfied customers to confirm its efficiency. So we will not make this review too long and bore you. Let’s just visit this page to hear it from the happy customers.

Main Features

Clepher’s main features are those that any good chatbot should have. Let’s look at them;

- Artificial Intelligence Chatbots

- Natural Language Processing technology

- Easy-to-use visual builder with drag-and-drop function

- 220+ pre-built chatbot templates

- Customizable elements

- Integration with over 50 native integrations, including Zapier and Make

- Can engage with customers and prospects on both Facebook and Instagram Inbox

- The Automation capabilities help eliminate 80% of repeat customer questions

- Integration with OpenAI makes it more knowledgeable

- Detailed analytics and reporting to track the performance

Pricing

- $199 per year

- $99 One-Time

- $49 per month

Growthbotics

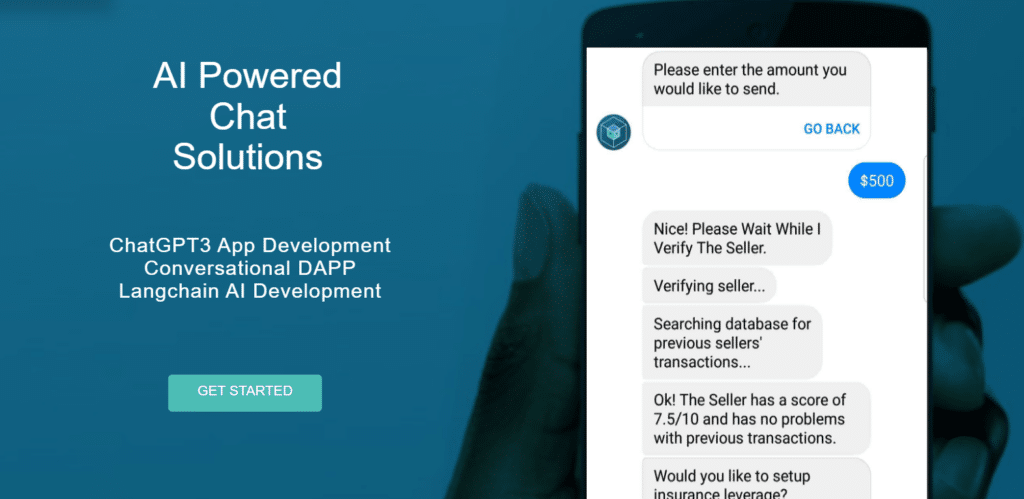

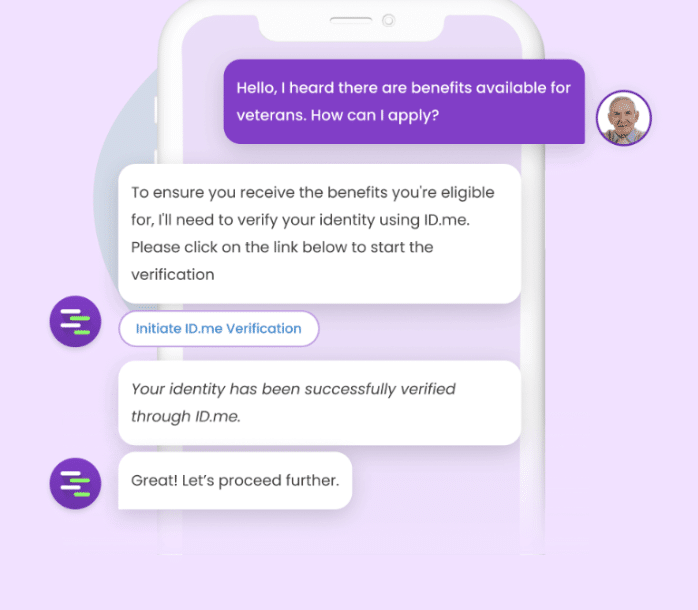

The Growthbotics chatbots are specifically designed for the financial banking and insurance industry. So, it is safe to say that each feature is designed to help you track your financial records or ensure that your client has the best experience while consulting an AI agent.

These finance chatbots help you grow your business to new peaks with double profits, quadruple conversions, and satisfied customers.

Growthbotics

So what Growthbotics does (other than having the basic features of a finance chatbot) is that it gets your customer onboard with AI sentiment assistance to familiarize your client with your policy and learn your system easily. Another unique feature is that it increases security by employing AI recognition and tokenization to open and shut doors.

Main Features

The following are the main features that Growthbotics offers;

- Automated account openings

- Enables customers to set up node or staking features

- Proof of concept building

- Uses AI to make predictions about loan applicants, i.e., identifying those who may not be able to pay back loans

- Automated customer onboarding

- Facilitating loan applications

- AI sentiment assistance

- AI recognition and tokenization

Pricing

- Free Demo

- Contact Growthbotics for custom pricing.

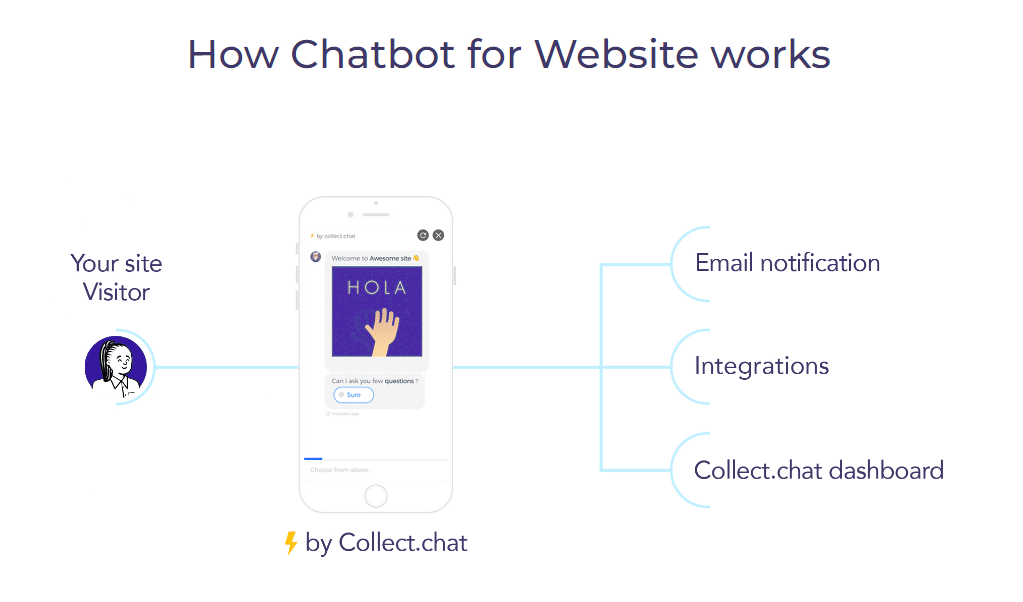

Collect.chat

Collect.chat stays true to its name and collects real-time feedback by assessing and analyzing its conversation with the customers. This platform has its template ready to use, but you can also customize it according to your business needs and customers.

Collect.chat

It has simple drag-and-drop visual builders, an attractive interface, and intuitive navigation. To get it running, you simply need to add your frequently asked questions and tweak the template.

According to Collect.chat, this finance chatbot gives 3x conversions.

Main Features

This one of the best finance chatbots has the following amazing features;

- Collect.chat allows you to build chatbots using a simple drag-and-drop interface without needing any coding knowledge

- Lead generation and data collection

- Customization and branding

- It can be designed in multiple languages to communicate with international customers

- It provides analytics and data visualization tools

- It has integrations with various marketing and CRM tools

- It has a WordPress plugin to add it to a WordPress website

Pricing

- Free

- Lite – $24 per month

- Standard – $49 per month

- Plus – $99 per month

Ultimate.ai

Need customer relation management (CRM) authorization? Well, Ultimate.ai is your answer. This virtual agent saves you from time-consuming repeated queries and improves self-service with fast responses. These customer-friendly features make it one of the best finance chatbots available in 2024.

Apart from providing fast CRM authorization, it also partners with many CRM platforms, including Zendesk, Genesys, Salesforce, and Freshworks.

Ultimate.AI

It can activate and unblock cards within chat to make the process easier and faster for your customers without them waiting for your agent to respond. Given your previous support data, Ultimate can also provide a multilingual virtual agent to create chats.

Main Features

The brilliance that Ultimate shows comes from the following features;

- It uses ChatGPT to create a chatbot that gives human-like responses to customer queries.

- This finance chatbot supports multiple languages.

- It automatically handles and resolves customer support tickets.

- This platform provides a dialogue builder tool to design custom chatbot conversations

- Ultimate integrates with many backend APIs

- It gives advanced analytics and gives insights from improvement if needed.

- Users can customize the chatbot’s tone to match the brand’s tone.

Pricing

- Contact Ultimate’s sales to learn about the prices.

Haptik

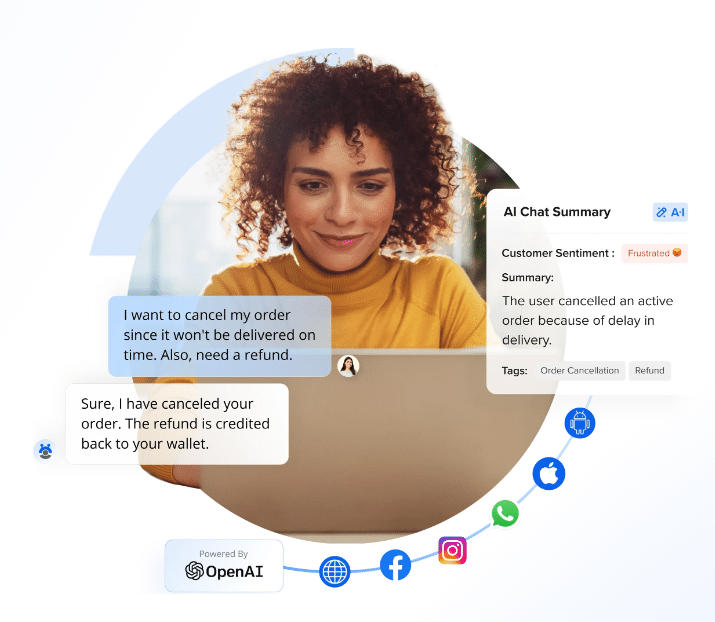

AI has raised the competition bars too high. If you want to win, Haptik is your buddy. It responds to each customer according to their individual experience, which helps increase the business’s revenue.

This bot gives buying guidelines, offers personalized recommendations, and shares feedback from your current clients. In other words, it gives you a face-to-face experience with your client and lifts 80% of the load from your shoulders.

Haptik

This bot was designed to gain the customer’s good experience by considering consumer needs.

Main Features

The main features that a Haptik chatbot has are;

- It gives human-like responses

- Notifies and gives alerts

- Provides directional cues while using the app

- Enables personalized interactions with the customers

- Supports multiple languages

- Automate financial processes

- Gives real-time information to customers

Pricing

- Contact Haptik’s sales for their different plan pricing.

Tars

Tars is ahead of the game when it comes to providing variety. It has 1000+ chatbot templates, of which 320 are finance and banking-specific. For your convenience, you can have it on your Whatsapp, your page as a chat widget, or a standalone page on your website.

Tars

You can use Tars as efficient customer service to ensure conversions and automate customer interactions. This finance chatbot was trained to mimic a human customer service agent, meaning you get a human-like response with no human error.

Main Features

Tars has the following main features to offer;

- Supports conversations in multiple languages

- No-code chatbot builder

- Enables integration with other applications through APIs.

- Supports multimedia content

- Users can upload files in the chatbot conversation

- It is integrated with Zapier

- Helps users with location and time-based input

- It has pre-build templates

- Uses NLP (natural language processing) to understand users and respond accordingly

- Gives human-like responses

Pricing

- Contact Tars to know the exact pricing.

Kore.ai

Kore proved its mettle when it earned the leader title in the 2023 Gartner Magic Quadrant for being an enterprise conversational AI. It helps you manage your money by expense tracking, providing invoice processing, giving reminders, etc. It also provides automated finance processes and accounting.

Kore.AI

Being the best finance chatbot, it helps you improve your finance accounting efficiency by taking charge of repetitive tasks and queries, leaving your agent to help a customer with rare concerns and tasks.

Main Features

The amazing features that Kore offers are;

- Can engage customers in 135+ languages

- XO Automation for creating personalized experiences for customers and employees

- Automation of 80% of common employee inquiries

- 3 NLP engines, i.e., Machine Learning, Fundamental Meaning, and Knowledge Graph

- It has tools and methods to develop ready-to-use chatbots or virtual assistants.

- Searches AI to provide accurate answers by using business data and content

- Support for 30+ enterprise, social, live chat, SMS, and email communication channels

Pricing

- Contact Kore.ai for pricing details.

Benefits of Finance Chatbots

We all know how beneficial finance chatbots can be. These chatbots have obvious benefits, such as time savings, lead generation, a higher conversion rate, and improved customer satisfaction.

Benefits of Finance Chatbots

Apart from these benefits, the best finance chatbots offer the following benefits;

- Lower Costs

- Efficiency

- Proactive Engagements

- Better Customer Feedback

Lower Costs

The costs of finance chatbots vary according to their features or your business needs. If you only want fast replies to customers, the costs will be considerably low, but if you want the chatbots for more than just Chats and require them to perform certain tasks such as finance management, alerts, and reminders, then the costs may go up, and rightfully so.

But even with the higher costs, these chatbots are less expensive than the salary you must give your customer service agents. No, we don’t mean they outright eliminate the need for those agents, but you will have to hire fewer agents if you have AI assistance available.

Additionally, an efficient chatbot generates more leads in less time, raises the conversion rate, and promises double profits.

Better Efficiency

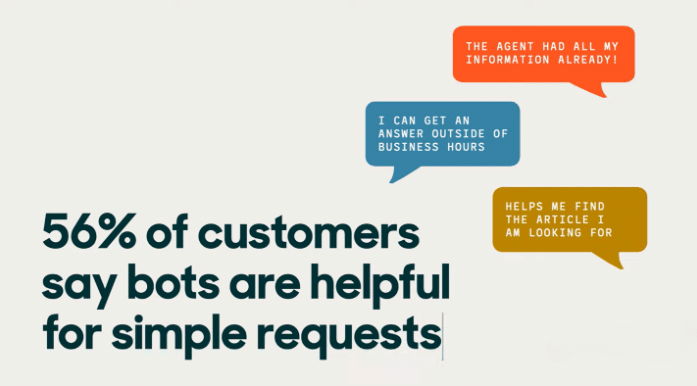

If your customer has many concerns and suddenly a question pops in their head at 3 AM, will your customer service agent be able to resolve it? Think not. Better for us, chatbots don’t sleep, nor do they make mistakes like a half-awake human.

So, other than giving the right answers at any time, how else do they increase a business’s efficiency? Its speed and capacity. They can handle hundreds of clients at once, make many transactions at a time, and fulfill multiple requests at once—all these tasks with happy and satisfied clients. On the other hand, a human agent is available for only one task, leaving the customers in a queue waiting, which is frustrating.

Proactive Engagements

The quick browsing of finance chatbots helps break down bank updates and financial advice for clients. They can cross-sell or upsell your financial products to your clients based on transaction history. This feature not only aids in generating leads but also ensures transparency with your clients, which is a plus point for your business as it earns your clients’ trust.

Installing chatbots helps build strong client relationships through proactive and honest engagements. More than 43% of US citizens prefer to resolve their problems with a chatbot rather than go to the branch.

Better Customer Feedback

How does a business improve its understanding and responsiveness to customer needs and preferences? Yes, with customers’ feedback. And we all know that feedback given to a bot is more frank and honest than to a person.

So, chatbots collect better feedback than human agents during their conversations with clients. Also, they automatically save the information, while humans can most likely forget it. Based on all the feedback that chatbots collect from users, they give better insight and even better suggestions for improvement.

Frequently Asked Questions (FAQs)

What are finance chatbots?

Finance chatbots help businesses related to the financial services industry, such as banks. These bots automate repetitive responses, help track transaction history, remind users to pay bills, and more. They provide 24/7 support for 365 days.

Which bank has the best chatbot?

There are so many banks with brilliant chatbots. Some of these banks are Ally Bank, which has the Ally Assist bot; HSBC, which has the Amy bot; Emirates NBD, which has the Eva chatbot; and Royal Bank of Scotland, which has the Cora bot.

How to use a chatbot for finance?

Using a finance chatbot means talking to a virtual agent. You can use chatbots for finance for many reasons, i.e., customer service, financial advice, transaction assistance, 24/7 availability, fraud detection and security, financial education, lead generation, better conversion rate, personalized recommendation, and feedback collection.

Related Posts